The suburbs have always seemed like an extremely affordable place to live, especially when you compare the suburbs to city living.

Suburban houses are generally larger and less expensive, and you can usually expect things like gas to be cheaper as well. However, there are a few things that contribute to some hidden costs of moving to the suburbs.

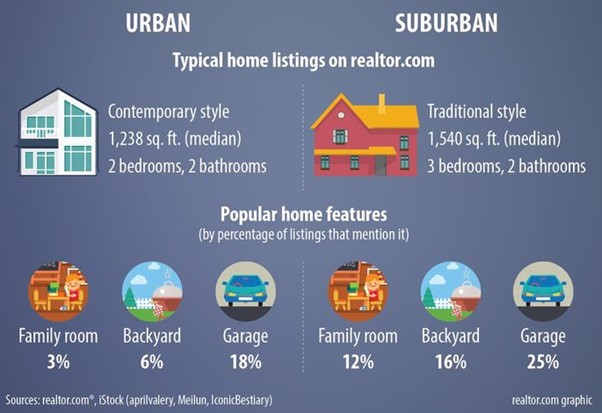

If you are planning on moving to the suburbs, you are more than likely going to be moving into a larger place than your current abode. The median home in a city center is about 1,238 square feet, and in the suburbs, the median home size is 1,540 square feet or more.

Here are a few extra costs that you will need to keep in mind before selling your current home and moving to the suburbs.

HOA Fees

In most suburbs, you will be required to pay a homeowner’s association (HOA) fee every month. This will cover the costs of neighborhood upkeep and amenities such as a pool or a playground.

If there is an HOA, chances are the home price will be higher as well. Houses in a neighborhood that have an HOA typically sell for 4% more than non-HOA neighborhoods.

Bigger Home, Bigger Yard, Bigger Costs

Even if you are moving from the city and have a yard, chances are it isn’t anywhere near as large as one that is in a suburban community. If you are planning on taking care of the yard by yourself, you will need to invest in the proper equipment to do so.

The proper equipment includes a lawnmower, weed whacker, fertilizer, and more items depending on what you are wanting to do. However, if you are not interested in taking care of the yard yourself, you will need to hire someone else to do it for you. This will be a cost you will need to expect to pay every month.

If you are planning on hiring a cleaning service to maintain your home for you, this will also be more expensive in the suburbs. A bigger house means more to clean, so you will have to consider that as well.

Furniture Shopping

When you move to a house that has more space, you are going to need more furniture to fill the space. This could mean a new bedroom suite for a spare room to be used as a guest room, a bigger couch for your living room, or an entire set of furniture for a basement.

Furniture is not cheap, and these expenses can add up quickly. Typically, a homebuyer will spend more than $8,000 on new furniture and decorations within their first two years of living in a new home. Make sure you have this cost accounted for if you need some new things.

Utilities

A larger home comes with larger bills, and that doesn’t just mean a larger house payment. There is more space and an open area that will need to be heated and cooled.

You will also likely have larger appliances that will need more energy to power. You will be using more electricity, water, and gas than you would in a smaller place.

For example, if your monthly electric bill costs you about $100 in the city, you can expect to pay about $120 in the suburbs. This seems like only a $20 difference, but these costs will add up quickly before you know it. That extra $20 a month adds up to $240 a year.

You will also need to remember that you will likely be paying for trash removal in the suburbs. This service can cost you anywhere from $30 to $50 depending on where you live.

Car Payments

When you live in a city, there are means of public transportation that are easily accessible from just about anywhere you would need. In the suburbs, there are way fewer options for public transportation, meaning you will need to own a car if you don’t already.

Owning a car is not a cheap expense. In 2019, the average car payment for a new car was over $550. You will also need to think about the costs associated with owning a car like insurance, maintenance, and gas prices. Speaking of gas prices, this will also make your commute to and from work more expensive.

Natural Disasters

In the suburbs, especially in a house with a basement, flooding is a massive problem that is experienced. If the area you are moving to has a higher number of trees, you can expect to have debris blown into your home, and you face a higher risk of trees falling on your property. It’s also possible for tree roots to break pipes that are underneath the yard.

Property Taxes

Property taxes are a major cost to consider because they can be wildly more expensive than you would think. Look at Chicago for example, the suburbs have rates of about 2% in the suburbs and 1.74% in the city. This is common because the suburbs have larger lot sizes than in the city, so you will have more space to pay for.

Sticking with the Chicago example, the property taxes in some counties of Illinois can range between $6,000 and $7,000 per year, costing more than $500 per month. In some cases, this could even be as much as your mortgage payment.

Property tax is one of the largest costs you will need to pay for your home, so make sure you are aware of how much it is going to cost you.

Conclusion

Living in the suburbs seems like an extremely ideal situation because you get more bang for your buck. You get more house and more yard than you do in the city at a lower price. Hard to pass up on, right? However, you will need to take into consideration all of the extra costs that living in the suburbs comes with.

Chances are, the suburb you are moving to has an HOA fee that needs to be paid every month. You will also need to prepare for higher utilities and transportation costs as well. There is less public transportation, so you will have to have a car, pay for insurance on it, and pay for gas to get to and from work. Check out even more details at the link below:

https://suburbanfinance.com/costs-of-living-in-the-suburbs/

Moving to the suburbs is a great choice if you are wanting to raise a family in a safe, spacious home. As long as you are aware of the costs and you can afford it, absolutely move to the suburbs.

For more great Suburban Finance articles, consider reading these:

Can You Have Two Car Loans At Once?