What if you could learn everything you need about finance in less than 10 minutes?

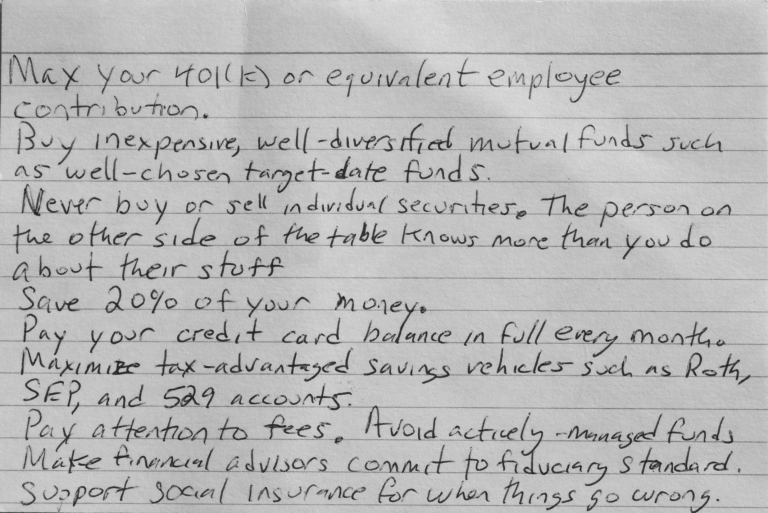

Well, according to University of Chicago professor Harold Pollard, everything that you need to know about money can fit on a simple 3×5 card. Pollard was chatting with journalist Helaine Olen about how necessary most of the financial planning industry is when Olen challenged Pollard to put everything down on paper. He did…and it went viral. Pollard had since published an entire book with Olen that further discusses the card.

Why would this be important to you? Because instead of paying for a financial advisor this 3×5 card has all the information you’ll need.

Financial 3×5 Card to Audio Book

We went ahead and dug up the audio book for you.

Everyone deserves the opportunity to have financial success. By following a few great pieces of advice, life can be exactly what you want it to be. Follow the information on the 3×5 card and listen to the book. In the time it takes you to read this article and listen to this little audiobook, make the decision to use these tools for your happily ever after.

Have you made the decision to use this information to improve your financial success? Let us know in the comments below.

Read More

Get A Financial Life by Beth Kobliner. In this book, Beth shares information geared towards those in their twenties and thirties. The personal finance in this book helps answers many questions that young adults have and normally get bad information when asking their peers.

Money Honey by Rachel Richards. Rachel describes the 7 steps you can take to have the financial life you desire and she adds some humor to it. She gives it to you straight to ensure that you get it.

How To Manage Your Money When You Don’t Have Any by Eric Wecks. If you are struggling month to month, then this is the book for you. Wecks explains how to go from being broke to financial stability.

Tamila McDonald has worked as a Financial Advisor for the military for past 13 years. She has taught Personal Financial classes on every subject from credit, to life insurance, as well as all other aspects of financial management. Mrs. McDonald is an AFCPE Accredited Financial Counselor and has helped her clients to meet their short-term and long-term financial goals.

I absolutely love this advice and couldn’t agree more with it. I think some of the biggest ones that I see my young professional peers struggling with are: not maxing out their 401(k), (some don’t even contribute enough to get the match), not paying off credit cards in full each month (interest will be a slippery slope to get out of control), and not holding their financial advisors to the fiduciary standard (most of my peers don’t even know what that is).

I personally have been focusing more on ‘watching out for the fees’, and was amazed when I found I could be paying 0.08% instead of 0.8% in my 401(k) for a similar fund!

Love it – so simple and invaluable for anyone really. I strongly urge people to take a look at this. Only thing I would add is that people should automate their savings -> this is the secret to achieving that 20% savings rate every month